8th Oct-2020 – for private circulation only

The Market Outlook

The Indian benchmark index was very volatile during the month of Sep-2020. The market went up to 39300 during the month of September and down by whopping 10% in the third week to 36550. The BSE Sensex again climbed up and settled down at 38000 level.

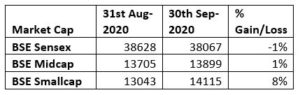

The BSE Sensex has delivered a positive return of -1%, BSE midcap delivered 1% return and the BSE Small cap index have delivered 8% in the month of Sep-2020. The smallcap has outperformed the largecap.

The Nifty 50’s P/E is high in the month of Sep-2020. The trailing Nifty 50 P/E stood at 32. This happens due to the poor earnings during the lock-down period.

The FII’s were the net sellers in the month of September-20 to the tune of 11400 Crs and the DII’s were the net buyers to the tune of 600 Crs. The gold import has declined in Sep-2020 as the demand for gold was declining.

What to expect in Oct-2020

The October being the month of quarterly result month. The results of the companies would be better than the last quarter results as the unlock down help the companies to start their operation, this would result in the earnings.

The market is going to be more volatile during the month of October-2020 due to nearing of US presidential election. All in all October could keep markets in a range bound before the Bihar elections and US elections determine a decisive course for the indices.

The security market regulator(SEBI) on the other side, keeps issuing various measures that may also impact the markets. For example, last month SEBI issued a regulatory guideline on how the multicap should allocate across the market category. The multicap should have 25% in all the market capitalisation like large, mid & small cap and the rest can be invested according to the investors discretion. This created a big noise in the market. The big players were having their assets skewed towards largecap and very little exposure on mid & smallcap during this time as the valuations of mid & smallcap is very high.

SEBI also announced the risk-o-meter for the debt fund category to ensure that the risk of each debt fund should be visible to the investors.

The business model is changing dynamically and the companies which are ready to adopt to the changes could survive in this market.

What the investor should do now? Be Cautious and continue SIP.

Fluctuations in the stock market are inevitable. Furthermore, the Nifty index is an indicator of a stock market, but the volatility of individual stocks depends on the company’s profit and loss.

The market could react positive based on the quarterly results of the companies, stimulus package announcement by various central banks across the globe.

The New normalcy post COVID-19 may have lot of impact on companies which are not adopt to the changes would vanish.

We always advise the investor to stay invest for a long period to avoid the surprise in the short term.

Equity

New investors are advised to make stock market based investments if they do not need money for at least 5 years.

The lazy investors can choose the asset allocation model to benefit from the market volatility. For example, if an investor has invested 70% in a stock-based mutual fund, 20% in a debt-based mutual fund and 10% gold. This proves to be the better model if one would like to invest for a long period of time.

It is the time to review your portfolio and rebalance the asset allocation. We recommend the investors not to invest lumpsum money in equity mutual funds. It is advisable to move the money into equity in a staggered manner.

As the market has done well across the market categories, it is the time to look at Large, Multicap, Value and selective midcap funds that would tend to provide a better return over a 3-5years period.

Gold as an asset class tend to perform well based on two factors. One during the uncertainty in the global economy. Secondly based on the demand. India as a country which imports gold largely next to China. The Gold price has touched all time high. It is advisable to have an asset allocation in place and one can buy gold at a staggered manner.

Debt

The present interest rates on a one-year fixed deposit is at around 4.9%-5.2%. The YTM of the liquid and ultra short term funds are in the range of 3-4.5% with the average modified duration of liquid funds in the range of 30-45 days and ultra short term in the range of 4 – 6 months. Having the above in mind, one can choose to invest in a liquid/money market funds having a quality portfolio with shorter maturity if one has the duration less than 6 months.

If you have a time horizon of 2-3 years, it is ideal to look at banking & PSU Debt, Short term and corporate bond funds. We strongly recommend the investors to avoid credit risk/medium term duration funds at this juncture. At this juncture, investors should curtail their expectation on return from the debt not more than 6-7% in any of the debt product.

If you need any advice on investments, do call us at 044-48612114/9940116967/9600048801.

Team Wealth Ladder

Sai House, 1st Floor, New No. 31/Old No. 13,

9th Avenue, Ashok Nagar, Chennai-600 083