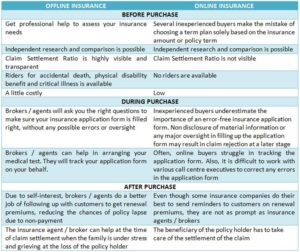

In the market, insurance companies are increasingly introducing online term plans for lesser premiums to customers. This, in one way, is exciting news as it means more savings. However, price shouldn’t be the main criteria for choosing something as important as term insurance. Here are a few pointers that will help you make the right decision between online and offline term insurance.

Is low premium the main criterion for choosing term plans?

In our view, low premium must never be the only criterion for choosing a term plan. Before you fall for the charms of such plans, you’ll need to look closely at the fine print. For starters, the ‘cheap’ premium paid for online term insurance often jumps up by 25% after the prospective customer undergoes a medical test. Also, after the medical test, if the proposer would like to decline the policy, the amount paid will be refunded to him only after the cost of the medical test that was borne by the insurance company has been deducted.

In some cases, a few leading insurance companies have started offering online term plans without conducting any medical test of the prospective customer. This is for term insurance policies that have a sum assured of up to Rs. 50 Lakh. One important point to note here is that such a customer has to disclose his entire medical history, and that can be used as evidence in the case of a claim.

Claim Settlement Ratio

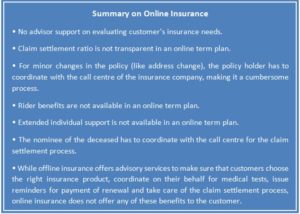

The claim settlement ratio for online insurance is not required to be mandatorily disclosed by insurance companies to the Insurance and Regulatory Development Authority (IRDA). As per IRDA guidelines, such a ratio declared by insurance companies is the combination of both online and offline insurance plans. Further, the lack of data available on the claim ratio of online plans hinders its clarity. As insurance companies have started offering online insurance plans only from the last 4-5 years, early claims will go through high scrutiny before the claim is settled.

Customer Support

The objective of a term plan is to acquire the sum assured amount when the policy holder dies. In the case of an online term plan, the proposer’s nominee has to coordinate with the designated call centre for the claim settlement. In the case of an offline plan, the advisor/broker is the one point contact. He will work on your behalf to help you get the claim from the insurance company. As per the insurance law, the agent/broker is the first underwriter to the customer as he is meeting the insurance buyer. Insurance is thus, the contract between the insurance company and the proposer which works on “UBERRIMA FIDE” (i.e. utmost good faith). Even small details that were missed out at the time of filing the online application form by the proposer leads to cancellation of claim proceeds.

Premium Comparison

The premium of online term plans varies from company to company and this leads to a lot of confusion among customers. The premium is factored based on various parameters like mortality rates, cost of medical tests and marketing costs. While a few companies are reducing their cost by offering term insurance without any medical test of the prospective customer (for up to Rs. 50 Lakh of the sum assured), such online term plans, in most instances, do not offer additional riders like accidental death, Permanent Disability Benefit (PDB) and critical illness coverage to customers.

To conclude, you must remember that cheaper premium alone should never be the criterion for choosing a term plan. Apart from the premium, all the above factors should also be considered before signing up for a term plan. We strongly advocate that offline term plans are best suited for individuals as it offers an array of beneficial services coupled with guided advice.

TEAM WEALTH LADDER