Why Senior Citizen Policy?

In General, the health insurance policies are available as a floater polices. In the family floater policies husband, wife, children and the parents are covered. However, the premium charges are higher if the parent ages are more than 60 years. Due to this reason, the insurance companies are started offering a separate senior citizen policies which covers the individual aged more than 60 years.

Medical Test

When someone wants to take the senior citizen policy, have to compulsorily undergo the medical test before taking the policy. Very Few insurance companies offer the senior citizen policies without medical test. The medical cost to be borne by the individual and the same will be refunded when they issue the policy.

All the pre-existing deceases get covered only after 2-3 policy years.

It is inevitable to know that the insurance policy holders have to compulsorily make a co-payment when hospitalized. i.e., when the policy holder is hospitalized for treatment, if the total claim is Rs.100,000. Then the policy holder should make a payment between of 20%-30%. The insurance company will settle on 70%-80% of the total claim amount. The co-payment may vary from company to company.

This is due to the additional facilities are being provided to the senior citizen. There are few companies which offer 24 X 7 call centers to help the individual emergency medical needs and queries. The other reason is that the normal causalities like head ache, leg pain are common in the senior citizen policies where the claim is higher.

There insurance companies avoid issuing family floater health policies to the senior citizen. It is available only as an individual policy. This is due to the risk of higher claim from the floater policies along with the charges are higher for the floater policies.

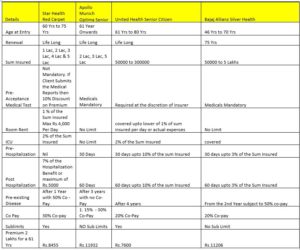

Senior Citizen Policies – A Comparison

Note: For all the policies, the waiting period is 30 days from the day of issuance.

Things to remember

The policy holders to look after the below important points after taking the policy

- It is very important to know your TPA (third party administrator) for your policies. In general, the insurance companies will transfer the claim process to the third party which is called as TPA. All the claim process and settlement will always be looked after the TPA.

- It is advisable to call the TPA and understand the insurance coverage, list of network hospital and list of exclusion. The main advantage of knowing the network hospital is to take the advantage of cashless claim. Otherwise, the policy holders have to make the payment to the hospital and then the same to be claimed from the insurance company.

- It is advisable to note the list of hospitals that are nearer to your residence and know whether they are the part of the insurance companies net work list.

- It is always better to know the co-payment limit for the policy which will help you prepare the differential amount when you are hospitalized.

- It is always advisable to make a note of the policy renewal due date and make the premium well ahead of the due date to avoid losing the pre-existing diseases cool off period.

- It is always advisable to use the policy very efficiently by not claiming the smaller amount which will help you accumulate and claim for the emergency higher claim deceases.

We always recommend you to save for medical emergencies apart from taking the medical policies which will help you when you have more medical needs in a year.

Team Wealth Ladder