7th Aug-2020 – for private circulation only

The Market Outlook

The Indian benchmark index was very volatile during the month of Jul-2020. The market during the month of July was driven by two factors. The top 5 companies having a weightage of 45% in the index rallies during July-2020. The other reason is that the first-time investors who started trading during the lock-down period. Though the investors sentiment is positive, the fundamentals are yet to become stronger.

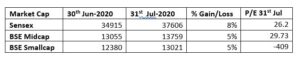

The BSE Sensex has delivered a positive return of 8%, BSE midcap delivered 5% return and the BSE Small cap index have delivered 5% in the month of Jul-2020.

During the month of Jul-2020, the FII’s were the net sellers in the debt market to the tune of 4,250 Crs. and net buying in equity to the tune of 7,563 Crs. However, the net buying by the FII’s stood at 3,300 crs.

The nifty 50 P/E level is at 30.2 which is above the average level. The investor needs to be cautious about the fresh investment at this level.

The P/E of smallcap index is negative. The negative P/E indicates the underlying companies are growing negatively or losing money. In few cases, the negative P/E indicate that the results were not declared. This may be due to the environmental factor like COVID-19 that are out of the company’s control.

RBI Monetary policy

The monetary policy committee (MPC) unanimously voted to leave repo rate unchanged at 4% and continue with accommodative stance of monetary policy as long as necessary to revive growth and mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. Reverse repo was also unchanged at 3.35%

Onetime restructuring of MSME loan which was standard as of 31st Mar-2020 can be restructured before 31st Mar-2021. This was earlier amended with the dating 1st Jan-2020. This gives little advantage to MSME sector. Secondly, the loan-to-value (LTV) on the gold loan for non-agricultural purpose has been raised from 75% to 90%. This helps the domestic borrowers to have more money in their hands against the gold.

The Equity Market

The market is moved positively due to the excess liquidity and the positive cues. The excerpts of the interview given by Kotak CIO, Harsh Upadyaya to Bloomberg Quint is hereunder.

The revival in demand seen in India so far has been supported by the Tier-II and Tier-III cities, but rising COVID-19 infection in the rural areas may hamper that. We need to see that this creates any administrative impact such as lock-down or consumer themselves will stay at home and not ventured out.

The Indian Equity market mostly recovered from its Mar-2020 sell-off, the worst in more than a decade, triggered by COVID-19 pandemic as several monetary and fiscal stimuli by the central bank and rescue packages by government buoyed sentiment. The economy is still headed toward a rare annual contraction in more than a decades, the government sees a rural India as lone bright spot.

He also pointed out that the overall activity level is improved. The only caution is that the market is driven by lot of liquidity by retail in the recent past and the institutional activity has been quite less. To that extend, if there is any reversal of sentiment, could be volatility on the downside.

It is very important to note that the domestic fund managers were the net sellers to the tune of Rs.10,000 crs during July-2020

The investor needs to be cautious about the above factor while investing fresh money into the equity market at this juncture.

What the investor should do now? Be Cautious and continue SIP.

The nifty 50 P/E level is at 30.2 as of July 31st 2020. This is happening first time in the last 20 years. This is way above the average level. The investor needs to be cautious about the fresh investment at this level.

Though there are some visibility in the rural economy growth, consumption positive and techno driven urban growth, we are yet to getting back to normal. Lockdowns, in a limited way, continue in many urban parts of the country.

Further, while the Nifty50 PE captures the PE of all 50 stocks, the contribution is skewed towards a handful of stocks. The top five heavy-weights – Reliance, TCS, HDFC Bank, Hindustan Unilever (HUL) and Infosys, now account for almost one-third of the overall market cap.

Moreover, the composition of the consumer goods sector has also increased with the inclusion of high-PE Nestle (PE of 76) and exclusion of low PE Indiabulls Housing (PE of 3.62). While this will have impacted the ratio by a few points, there is no denying the fact that markets are in a danger zone.

The results of Apr-Jun quarter have proven that few of the sectors are the winners. Especially, the technology, pharma, telecom and Agri products were all the winners though there was a lockdown. The next level of winner is a two wheeler market in the rural area has picked up even before the COVID-19 level.

We always advise the investor to stay invest for a long period to avoid the surprise in the short term.

Equity

It is the time to review your portfolio and rebalance the asset allocation. We recommend the investors not to invest lumpsum money in equity mutual funds. It is advisable to move the money into equity in a staggered manner. We recommend the investor to stay away from small cap right now as it takes a little longer time to recover the losses incurred during the last 5 years.

As the market has done well across the market categories, it is the time to look at Multicap, Value and selective midcap funds that would tend to provide a better return over a 3-5years period.

Gold as an asset class tend to perform well based on two factors. One during the uncertainty in the global economy. Secondly based on the demand. India as a country which imports gold largely next to China. The Gold price has touched all time high. It is advisable to have an asset allocation in place and one can buy gold at a staggered manner.

Debt

The Yield to maturity on various debt funds have shrunk. The positive news is that the recovery in few of the debt securities that were defaulted.

We recommend the investors to look at the funds that holds the portfolio in a AAA in long term and A1 in short term papers. We recommend the investors to look at short term funds with short maturity papers. We recommend low duration, ultra-short term, and money market funds if one would like to hold the investment for a period of around 1 year. If you have a time horizon of 2-3 years, it is ideal to look at banking & PSU Debt and corporate bond funds. We strongly recommend the investors to avoid credit risk/medium term duration funds to have a shock after the lock-down. We expect the credit rating would be revised downwards for few companies that may impact the credit risk/medium term funds. At this juncture, investors should curtail their expectation on return from the debt not more than 6-7% in any of the debt product.

If you need any advice on investments, do call us at 044-48612114/9940116967/9600048801.

Team Wealth Ladder

Sai House, 1st Floor, New No. 31/Old No. 13,

9th Avenue, Ashok Nagar, Chennai-600 083