July 2020 – for private circulation only

The Market Outlook

The Indian benchmark index was trading positive for the entire month of Jun-2020. The market during the month of June was driven by the sentiment that the hope in the recovery of economy due to Unlock-1.0 announced by the government. The easing of lock-down, slowdown in infection, recovery rate and progress of COVID-19 vaccine development led to positive sentiments.

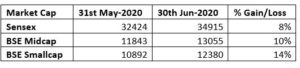

The BSE Sensex has delivered a positive return of 8%, BSE midcap delivered 10% return and the BSE Small cap index have delivered 14% in the month of Jun-2020.

The Sensex was trading 25,000 level in Jul-2014 and 36,000 level in 2018. It delivered 39% returns in 4 years. But the same return was delivered in 4 months between Mar-2020 to Jun-2020.

During the month of Jun-2020, the FII’s were the net sellers in the debt market to the tune of 1,500 Crs. and net buying in equity to the tune of 21,800 Crs.

The Fundamental Attribute of Indian Economy

There is a famous quote by Arnold Glasgow, “Nothing last for Ever, not even your troubles”

This is applicable for the Indian Economy as well. Tough times do not last, but tough economies do. The Indian economy has grown steadily despite several challenges in the past and present. The below chart shows, the different crisis and events happened during the last few decades.

Source : HDFC Market outlook

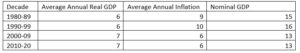

The below table depicts the nominal GDP during the same period. Though there were various events and crisis during the last few decade, the average decadal nominal GDP growth was above 13%. This means the long-term average equity return could be in the range of 12-15%. The nominal GDP is the addition of GDP and Inflation.

The trigger that may chart the future course of market direction

- The trajectory of COVID-19 Growth

- The second wave of COVID-19

- Vaccine development

- US-China Trade Tensions

- Indo-China Border Tensions

Though the market during the last quarter was driven by the liquidity available in the market. The market may move in either direction based on the above situation.

The rural India is unaffected by Lockdown and is poised to benefit from higher price, output and government spending. Long pending reforms in the agri sector lead to better supply chain and higher pricing for farmers. The amendment of essential commodity act, agricultural product marketing company is benefiting the farmers and exclusively the rural India. The MNREGA employment during Jun-2020 is awfully close to Feb-2020 level.

What the investor should do now? Why Invest Now?

The last few months run up in the market makes the investor baffling whether we missed the bus. Always, the crisis presents an opportunity, but we are not sure the long-term sustainability of the runup happened in the short period of time.

The last few weeks rally in the market is discounting the future on various factors like oil prices, gold import, trade deficit with China, Rebound economic activities, monetary stimulus, Potential higher FPI inflows, economic recovery and vaccine for COVID-19 is near from far.

The results of Apr-Jun quarter going to be worst due to the lock-down. However, the market has discounted this factor. The results of the companies would be declared during this month. The corporate results would trigger the market negatively if the results are poorer than the expectation. We recommend the investor to take a middle path so that there is no shock in the short term and not missing the opportunity on the other side.

We always advise the investor to stay invest for a long period to avoid the surprise in the short term.

Equity

It is the time to review your portfolio and rebalance the asset allocation. We recommend the investors not to invest lumpsum money in equity mutual funds. It is advisable to move the money into equity in a staggered manner. We recommend the investor to stay away from small cap right now as it takes a little longer time to recover the losses incurred during the last 5 years.

As the market has done well across the market categories, it is the time to look at Multicap, Value and selective midcap funds that would tend to provide a better return over a 3-5years period.

Debt

The Yield to maturity on various debt funds have shrunk. The positive news is that the recovery in few of the debt securities that were defaulted.

We recommend the investors to look at the funds that holds the portfolio in a AAA in long term and A1 in short term papers. We recommend the investors to look at short term funds with short maturity papers. We recommend low duration, ultra-short term, and money market funds if one would like to hold the investment for a period of around 1 year. If you have a time horizon of 2-3 years, it is ideal to look at banking & PSU Debt and corporate bond funds. We strongly recommend the investors to avoid credit risk/medium term duration funds to have a shock after the lock-down. We expect the credit rating would be revised downwards for few companies that may impact the credit risk/medium term funds.

If you need any advice on investments, do call us at 044-48612114/9940116967/9600048801.

Team Wealth Ladder